If competitors launch new products, offer better prices, or implement aggressive marketing strategies, a business might experience a decrease in its sales volume. Conversely, if a company gains a competitive edge through innovation, superior customer service, or unique value propositions, it can capture a larger market share and increase its sales volume. Sales variance analysis is used by managers for identifying and understanding the reasons why the actual sales performance of a business differs from its original budgeted sales. A sales value variance, also known as a budgeted profit variance, concerns the difference in budgeted and actual cost of production.

Examples of Calculating Sales Price Variance

In contrast, during economic downturns, consumers may cut back on spending, resulting in lower sales volumes. The selling quantity will increase if we decrease the price and vice versa. During this sales period, your company sells all 100 potted pothos plants for $35. Using the formula, we can calculate the sales variance for the potted pothos plants. Specialized software like Anaplan and Adaptive Insights is designed for financial planning and analysis.

Stay on Track with Sales Variance

Alternatively, if the actual selling price is higher, it is a favorable condition. It is unlikely that a business will have sales results that exactly match budgeted sales, so either favorable or unfavorable variances will appear in another column. These variances are important to keep track of because they provide information for the business owner or manager on where the business is successful and where it is not. Large and small businesses prepare monthly budgets that show forecasted sales and expenses for upcoming periods. This negative variance of $5,000 shows that the company had to reduce its selling price, resulting in lower than expected revenue. The effectiveness of a company’s distribution channels can also affect sales volume.

Sales Variance Outcomes

Therefore, the selling price variance for XYZ in March 2023 amounts to $4,000. One of the most common pitfalls in variance analysis is misinterpreting data. This can occur when businesses fail to consider the context behind the numbers, leading to incorrect conclusions and potentially misguided decisions. Broader economic conditions, such as inflation, unemployment rates, and consumer confidence, can influence sales volume. During periods of economic growth, consumers are more likely to spend, leading to higher sales volumes.

- For instance, a company might adopt a discount pricing strategy to attract more customers, which could lead to a lower actual selling price compared to the budgeted price.

- Calculating Mix variance separately in this way is important because each product has a different profit margin.

- Promotional activities such as discounts, special offers, and loyalty programs can temporarily lower the selling price to boost sales.

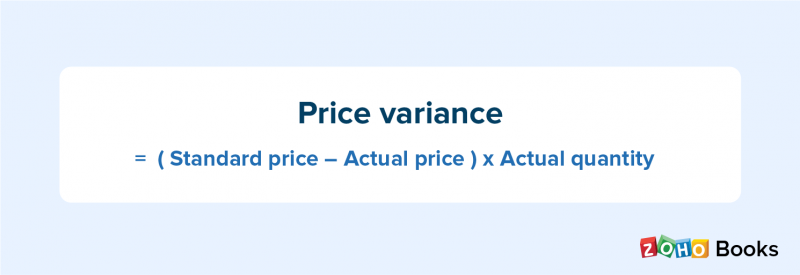

(2018 Selling price – 2017 Selling price) x Units sold in 2018.

Selling price variance is a type of sales variance that accounts for the difference in price for goods or services compared to the expected selling price. Selling price variance can impact the company‘s revenue goals either positively or negatively if it isn’t calculated and anticipated. The cost of goods sold (COGS) directly affects the pricing decisions of a business.

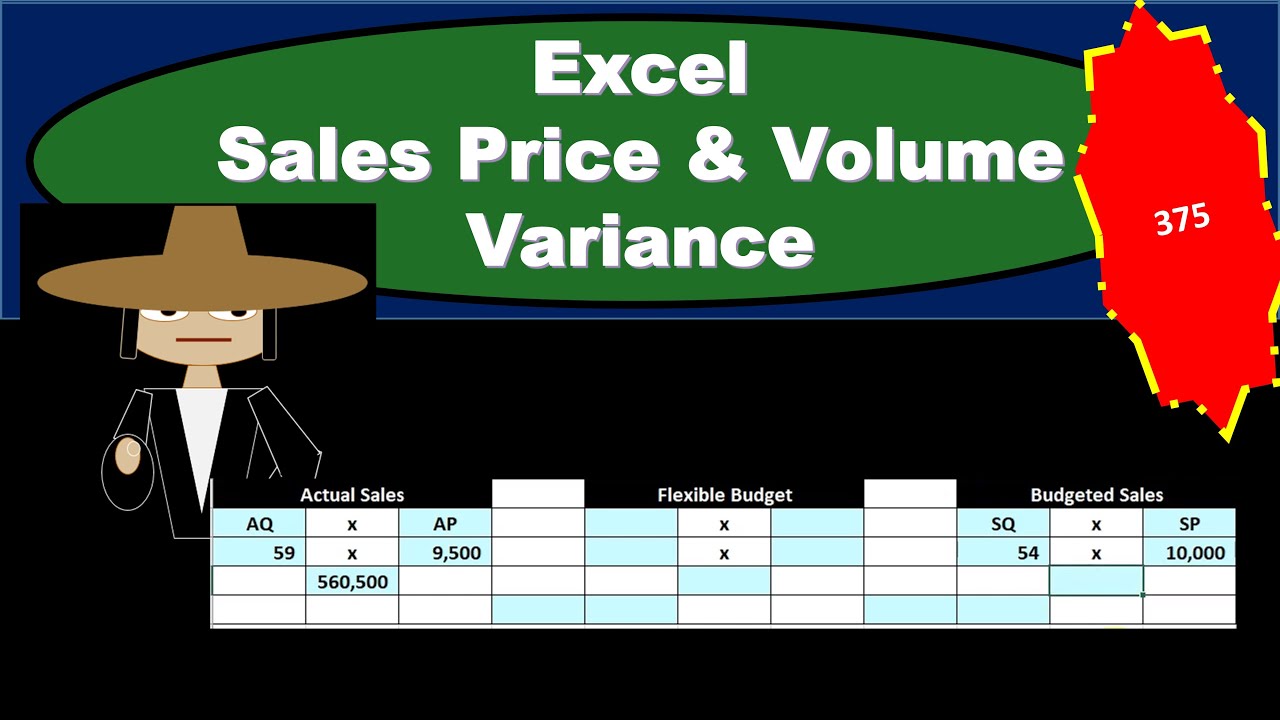

You can have both sales price variance and sales volume variance together, or one of each, at a time. The store ends up selling all 50 shirts at the $15 price, bringing in a gross sales total of $750. The store’s sales price variance is the $1,000 standard or expected sales revenue minus $750 actual revenue received, for a difference of $250. Remember we are trying to explain the impact of Sales variances on profit margin, not total Sales $. If we had taken Selling price instead of Profit margin, we would be explaining Sales $ variance (change in Sales $ from 2017 to 2018), but we are calculating the impact on Profit margin. For each increase or decrease in unit sold vs last year, the profit margin will be impacted only by the amount of profit margin per unit and not the total Sales value.

Again the term standard price could be used instead of budgeted price in the formula above. Furthermore the total sales variance can be split into two main components. Hence, the case study demonstrates how the soft drink company was able to manage transaction volumes and track purchase price variance for raw materials. education or student tax credits you can get on your tax return The management has already estimated the product price in advance, however, during a product launch, they have set a different price. The market price change all the time due to supply and demand which increase or decrease the price. There are various reasons such as competition, change in demand, inflation, and so on.

When multiplied by the actual volume 13,500 the sales price variance is determined as 9,450. This analysis provides insights into how actual costs align with budgeted costs. It aids in refining budgeting processes and adjusting financial plans to account for unexpected cost fluctuations. Price variance refers to the difference between the actual price paid for a product, material, or service and the expected price for that exact item. It plays a significant role in preparing a budget and helps a business become aware of the costs that need to be addressed as they have either exceeded the cost or remained short of meeting the expected price.

Sales price variance is the difference between the price at which a business expects to sell its products or services and what it actually sells them for. Sales price variances are said to be either “favorable,” or sold for a higher-than-targeted price, or “unfavorable” when they sell for less than the targeted or standard price. For instance, changes in taxation, import duties, or minimum wage laws can affect the cost structure and pricing strategies of businesses. Compliance with new regulations might lead to price adjustments, influencing the actual selling price. Sales price variance represents the difference between actual sales dollars and budgeted sales dollars that has occurred because actual price is different from the budgeted price. Sales volume variance measures the difference between expected units sold and actual units sold.

Leave a Reply